On the afternoon of March 21, the “2023 China Mobile Robot (AGV/AMR) Industry Development Research Report” was officially released online. Peng Qing, editor-in-chief of the Information Department of the CMR Industry Alliance, explained the core content of the report!

Report Description

Report data source: Survey and collection of data from more than 150 domestic and foreign ontology companies and nearly 100 supply chain companies.

Research methods: issuing survey forms, supply chain and customer verification, visiting enterprises, interviewing relevant persons in charge of enterprises, etc.

Report content: The entire 8 chapters, 120 pages, and over 180 charts analyze the current Chinese mobile robot market from different angles. Including sales scale and quantity, popular segmented application areas, popular segmented product categories, analysis of each part of the industry chain, representative companies in the Chinese market, future development trends, etc.

The overall sales scale is 21.2 billion, and the sales volume is 125,000 units.

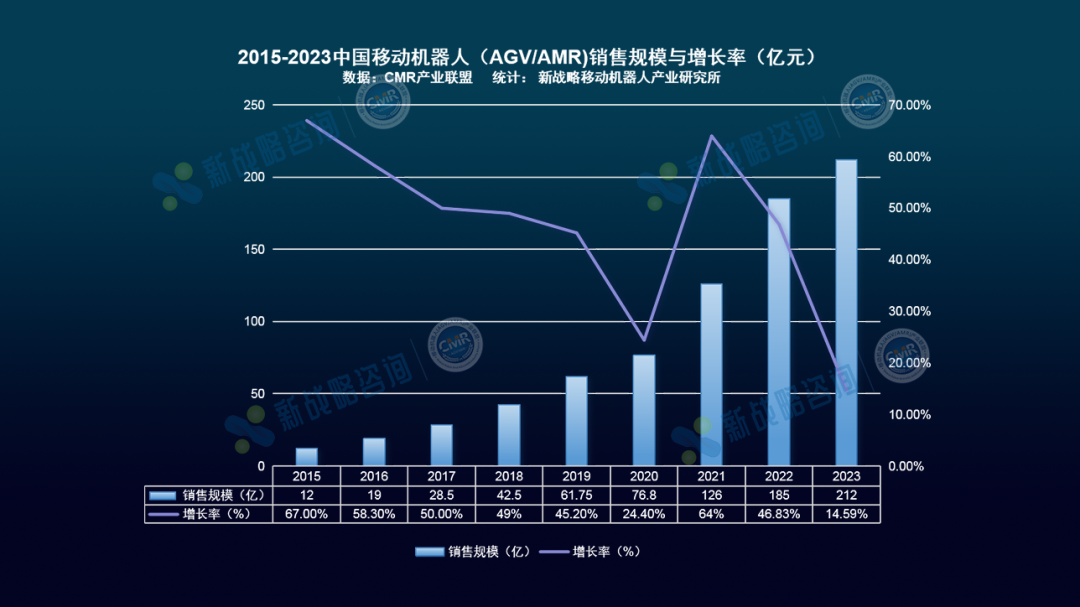

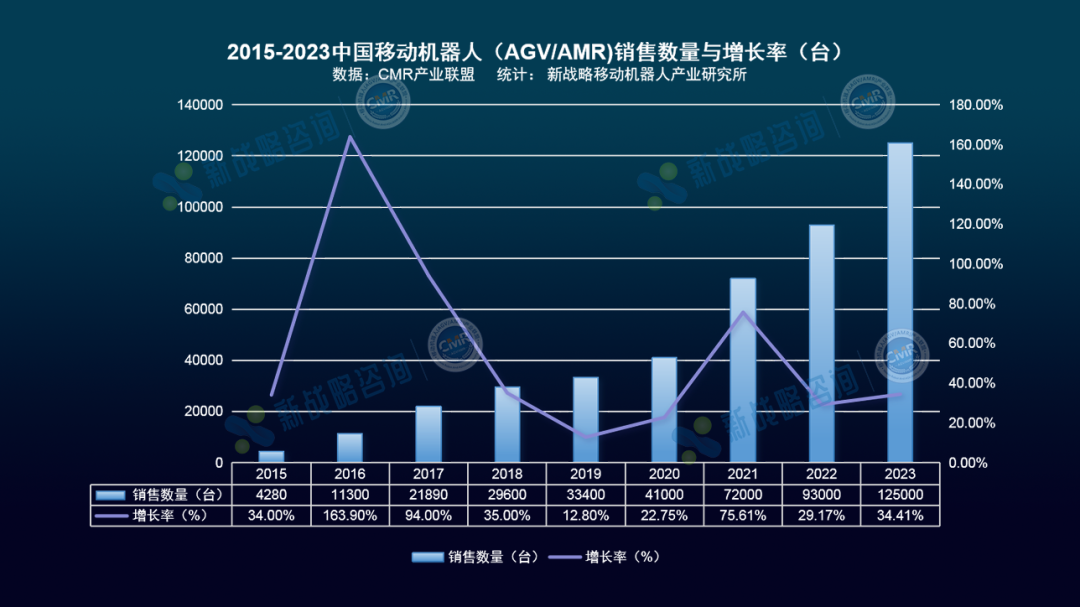

According to CMR Industry Alliance data and statistics from the New Strategy Mobile Robot Industry Research Institute, from 2015 to 2023, the compound annual growth rate of the mobile robot (AGV/AMR) industry in the Chinese market reached 43.18%; in 2023, China’s mobile robot (AGV/AMR) The sales scale is approximately 21.2 billion, a year-on-year increase of 14.59%; the sales volume is approximately 125,000 units, a year-on-year increase of 34.41%.

Chart: Sales scale and growth rate of China’s industrial application mobile robots (AGV/AMR) from 2015 to 2023

Chart: Sales volume and growth rate of China’s industrial application mobile robots (AGV/AMR) from 2015 to 2023

Chart: Sales volume and growth rate of China’s industrial application mobile robots (AGV/AMR) from 2015 to 2023

Competitive landscape: 42 companies with over RMB 100 million, 5 companies with over RMB 1 billion

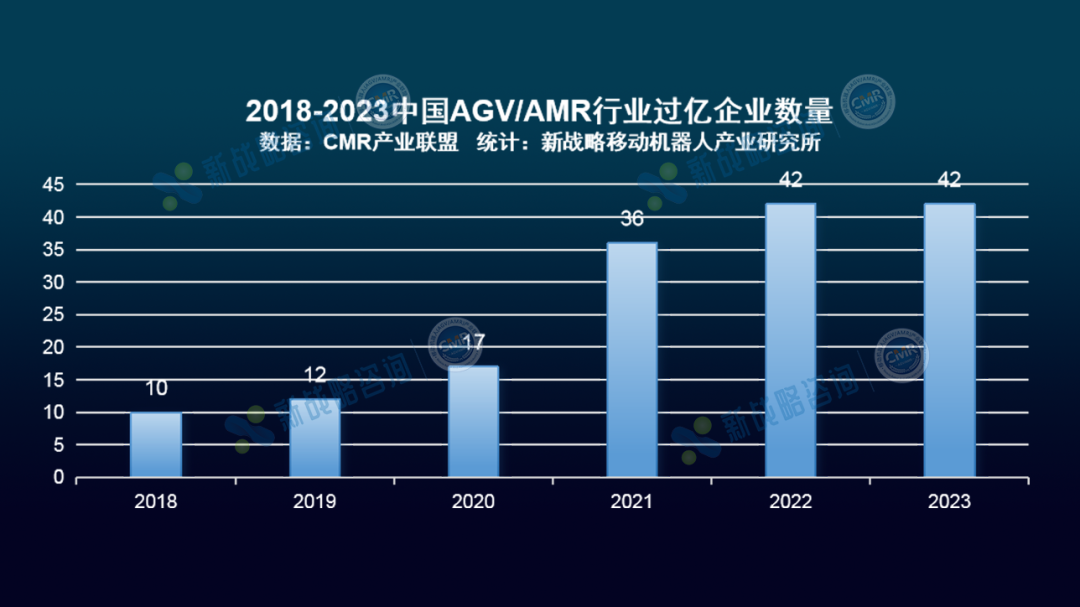

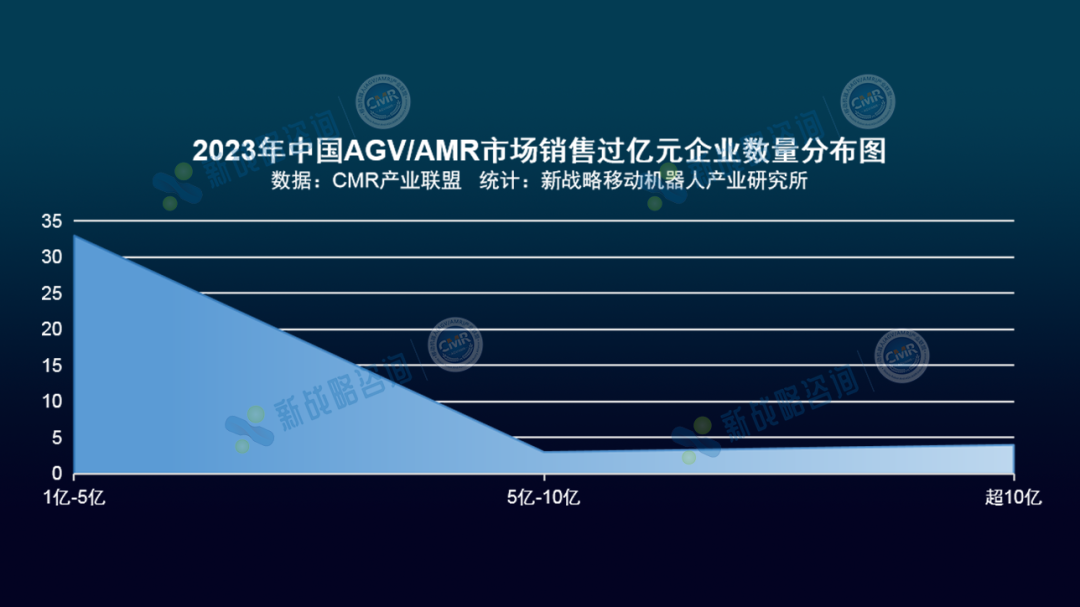

According to statistics, in 2022, there will be 42 AGV/AMR companies in the Chinese market with sales exceeding 100 million yuan, and 3 companies with sales ranging from 500 million to 1 billion yuan. It can be seen that the number of companies with over 100 million yuan has stabilized in the past two years, and the basic pattern of the industry has initially emerged.

Chart: Number of companies in China’s AGV/AMR industry exceeding 100 million in 2018-2023

Chart: Distribution of the number of companies with sales exceeding 100 million yuan in China’s AGV/AMR market in 2023

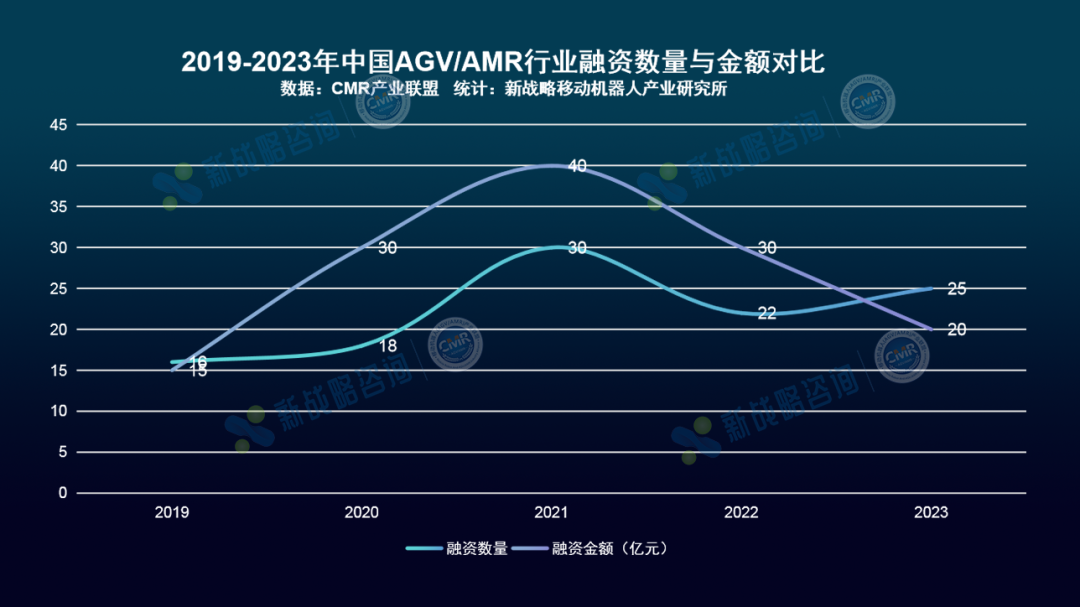

There were a total of 25 financings in the industry throughout the year, with a total amount exceeding 2 billion

In 2023, a total of 25 financing events occurred in China’s AGV/AMR field, with the total financing amount exceeding 2 billion yuan. Compared with the significant reduction in overall industry financing in 2022, the capital market has gradually become colder. It is worth noting that most corporate financing in 2023 will involve local government capital participation, and government industrial investment will pay more attention to the industry.

Chart: Comparison of financing quantity and amount in China’s AGV/AMR industry from 2019 to 2023

For more market data, see the full report! The complete electronic version of the report will be officially released to the public from now on.